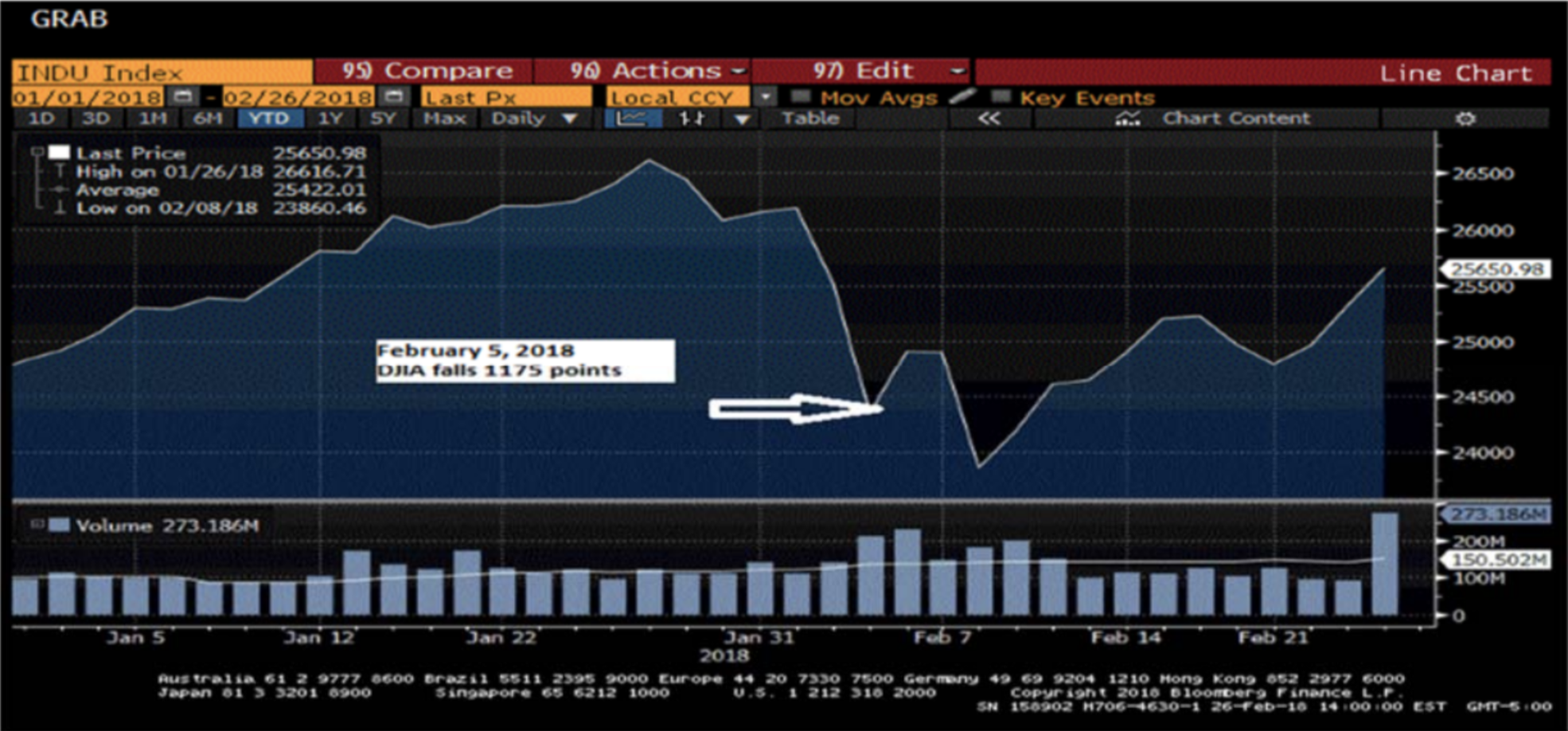

For a while it seemed like the market could do nothing but go up, and up. Until that fateful Monday when we saw the DJIA all a breathtaking 1175 points. It was a stunning afternoon as we saw it drop as much as 1600 points at one point.

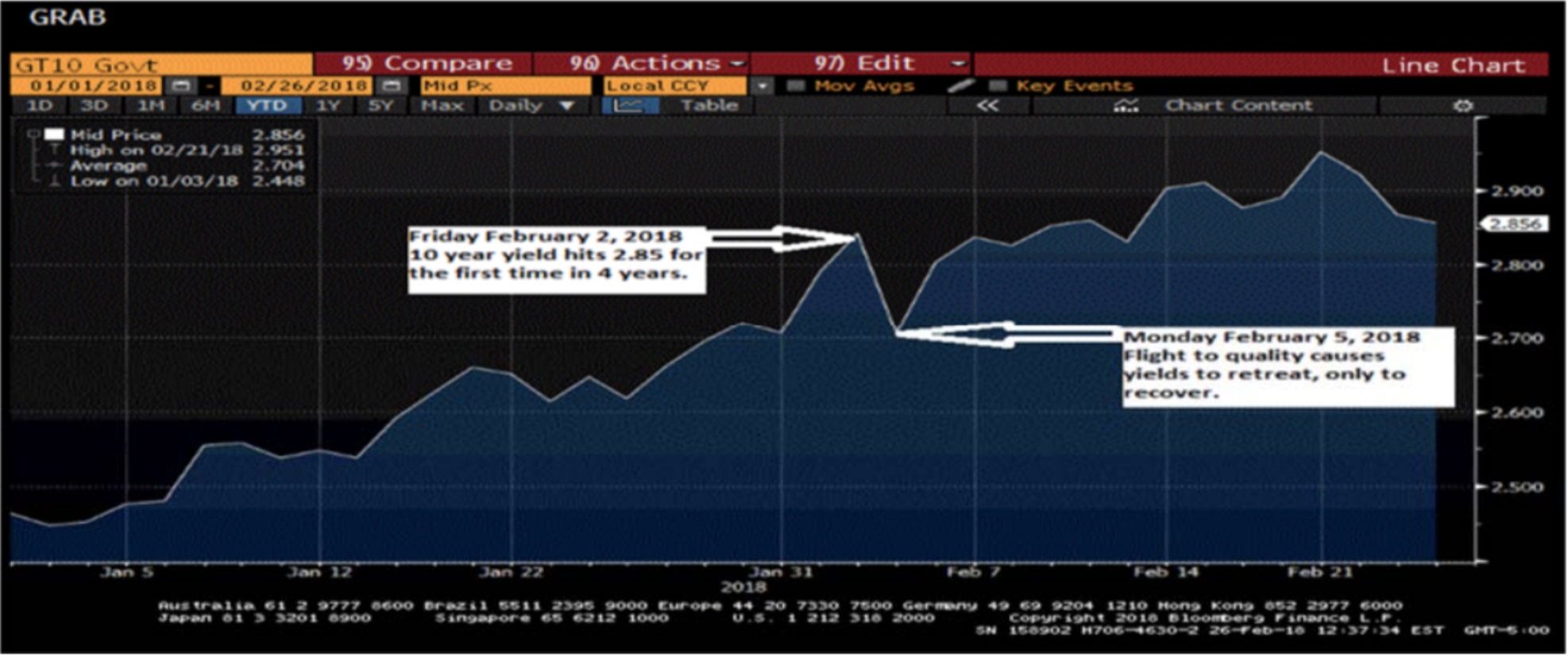

In order to understand this we need to see what is really driving the bus. As is the case many times in the markets, bonds were a telling a different story and may have initiated the sell-off.

On Friday February 2, 2018 the benchmark 10 year treasury bond hit 2.85. We haven’t seen a yield that high since March of 2014. Since the beginning of the year, we saw the 10 year bond go from 2.44 to 2.85 or increase over 40% in a little over a month. Higher yields in bonds could be signaling that inflation is coming and this could stunt the growing Economy.

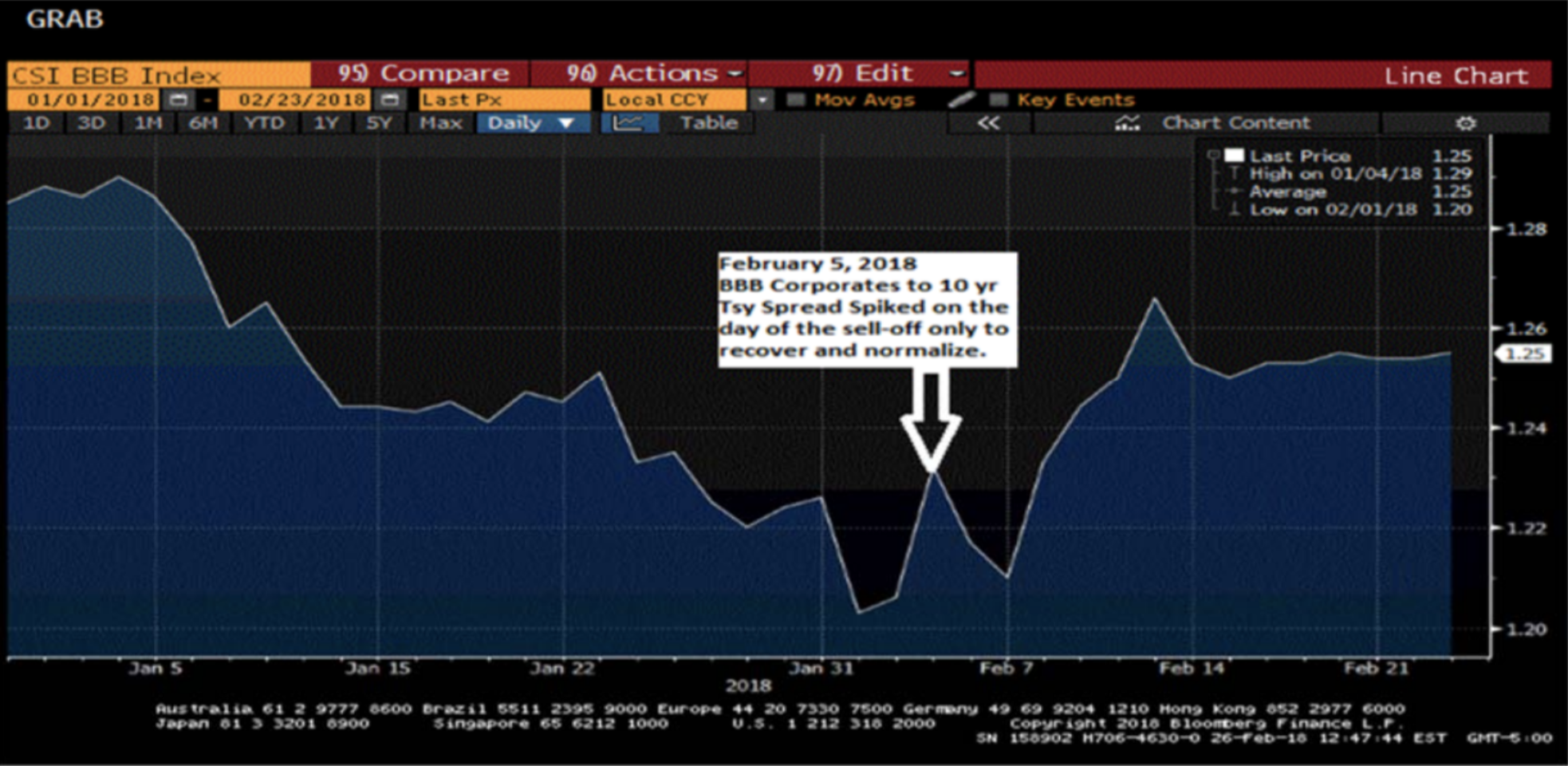

But what about the bonds we are buying at WEG? How do they behave when markets are volatile?

This graph shows BBB rated corporate bonds vs the benchmark 10 year Treasury bond. This spread has been grinding

lower since early 2016 when it was about 2.25 or 225 bps over treasuries. When we had the sell-off, the spread popped up, only to recover and normalize.

Municipal bonds also had a spike on February 5, 2018. Municipal spreads are also quoted in relation to the 10 year treasury. Municipal bonds yields spiked up to 91% of the 10 year Treasury bond. However, they remain elevated from their previous levels at around 86%.

As always, if you would like more information on how individual bonds or bond ladders can help you or your clients,

please feel free to reach out to me on the Bond Desk.